- Alternate Universe

- Posts

- Social Arbitrage Investing 📱👩💻

Social Arbitrage Investing 📱👩💻

The only reason to use Twitter and TikTok 😛

Welcome to Alternate Universe!

In today’s edition:

Using social media to find your next investments 📱

Job opportunities at recently funded European startups 👇

Financial engineering in PE might not be working so well anymore 🤔

The Crux 🔴

What if I said you could turn €20k into €20 million using nothing but Twitter or TikTok and a zero-commission trading app?

You would probably think I’m some dodgy scammer trying to sell a pyramid scheme not too dissimilar to the random ads you get while browsing the internet.

Well, this is not BS.

One guy, did just that, creating a new investing school of thought in the process.

🐰🕳️⌚

Investing typically revolves around two key approaches: fundamental and technical analysis. Fundamental analysis involves deeply understanding a business's operations and how broader economic and industry conditions affect its financial performance. The goal is to assess a company’s intrinsic value to determine whether its stock is under- or over-priced.

On the other hand, technical analysts focus on statistical trends to predict future stock price movements. Both styles have their strengths, weaknesses, and loyal followers.

Enter Chris Camillo, a Texan who has pioneered a new market analysis and trading method known as ‘social arbitrage.’

Camillo’s strategy relies on tracking social trends in everyday life and interpreting how they could influence stock movements—both positively and negatively. His approach is supported by sophisticated social monitoring systems that analyze thousands of keywords and combinations. Together with his two friends, Dave and Jordan, Camillo co-founded the YouTube channel Dumb Money, which stands as a counterpoint to traditional Wall Street elites.

The name might ring a bell. The movie Dumb Money, which explores the 2020 meme stock frenzy, secured the rights to use the name from their group.

Chris is the pack's leader, known for his bold moves and willingness to take risks. In one interview, he recalls his early start in social arbitrage, inspired by his brother's trading advice. After noticing a shortage of Snapple drinks at a local 7-Eleven, a young Chris learned from the store clerk that the brand was losing shelf space to competitors. Armed with this insight, he shorted Snapple stock, making a few hundred dollars and sparking a lifelong passion for social arbitrage.

Key Tools 🛠️

The trio use Twitter and RobinHood to execute their strategy. Chris admitted to spending long hours going down rabbit holes on obscure topics on Reddit, TikTok, Instagram and Google Trends to understand how the customer thinks, before Wall Street takes note. As the Dumb Money channel grew, the trio spawned a separate Discord channel full of raving fans, who also perform deep dives on various stocks around the globe.

Besides online research, Chris frequently makes trips to physical stores, speaking to employees to gain real-life feedback to validate his thesis. Camillo’s other tools in the arsenal, was TickerTags, a social data intelligence company he founded back in 2015. The scope was to gather as much data as possible by scraping Twitter and other social media channels to have a more refined signal in making investment decisions. Ticker Tags was acquired in 2018.

Investment Implications 🤑

The concept and the Dumb Money channel immediately intrigued me—it felt fresh and novel. It’s the classic David vs. Goliath narrative: the little guy making trades on his smartphone, while the banker sits behind a Bloomberg terminal.

Could it all be hype?

Determined to be more mindful of everyday opportunities and trends, I soon spotted one. At the time, I was working in healthcare during the chaos of the COVID-19 pandemic. The market was in freefall, with the Dow Jones plunging 31.7% from its peak on February 12 to its lowest point on March 16, 2020. Yet, resilient sectors like healthcare and software were seen as safe bets amidst the turmoil.

One product was everywhere, flying off the shelves—surgical gloves.

The pandemic, combined with the disposable nature of the product, made this a prime candidate for a social arbitrage trade. After a quick search, I identified two major publicly traded suppliers: Top Glove, based in Malaysia, and Mercator Medical from Poland.

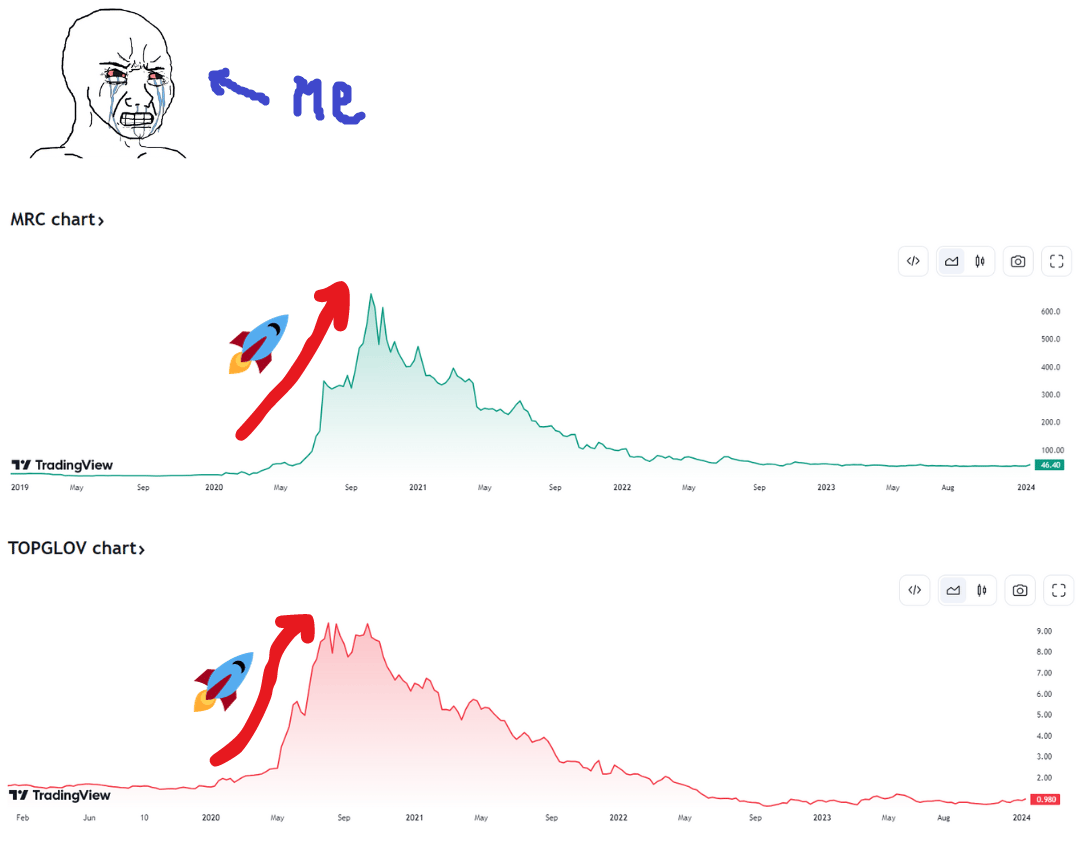

Top Glove’s stock soared from 2 MYR to 9.3 MYR per share in a matter of months—a massive 466.5% increase.

Mercator Medical did even better, skyrocketing from 16 PLN to 664 PLN per share—a staggering 4,150% surge.

Had I invested €1,000 in each of these stocks at the start of the pandemic, I could have made a cool €45,000 in profit. Unfortunately, neither stock was available through the local brokerage platforms I used.

In May 2022, a similar opportunity in healthcare emerged when the U.S. reported its first case of monkeypox in Boston. Chaos quickly followed, with media outlets painting a bleak picture. The main symptoms—rashes, fever, and muscle aches—soon began to spread across multiple countries.

The kicker?

There was no significant supply of monkeypox vaccines.

But for diligent investors, there were hidden gems.

Two companies, to be precise: Bavarian Nordic and SIGA Technologies. These Danish and American firms had portfolios focused on infectious diseases, including smallpox, cowpox, and—critically—monkeypox. As news of the outbreak spread, their stock prices surged by nearly 200% over the summer, offering strong gains in an otherwise macro-dominated market.

Despite these stocks being tradeable, I missed the opportunity. Shameful.

(I did manage to pull the trigger in this year’s monkeypox announcements however - read more here)

As they say, the third time’s a charm.

The Dumb Money community began buzzing about Bud Light, a popular beer brand among older U.S. consumers. AB InBev, Bud Light’s parent company, had sent custom celebratory cans to LGBTQ+ influencer Dylan Mulvaney as part of a campaign to attract a younger audience.

The plan backfired spectacularly.

Bud Light’s predominantly conservative customer base responded with outrage, posting boycott videos. Kid Rock even shared a video of himself using the cans as target practice.

This was a clear investment opportunity.

The obvious move would have been to short the stock. However, Bud Light is just one piece of AB InBev’s vast brand portfolio, so a decline in its sales wouldn’t have significantly impacted the stock price.

The better move?

Buying shares of Molson Coors, the maker of Miller Light and Coors Light—Bud Light’s biggest rivals. During their next earnings call, Molson Coors reported its best quarter since the 2005 merger.

And the result? Not bad at all. Molson Coors’ stock (TAP) jumped nearly 30% in just one month. This time, I didn’t miss out!

Risks & Limitations ⛔

Hindsight is 20/20. This trading strategy comes with its fair share of risks and limitations. Knowing when to exit a trade is just as crucial as knowing when to enter. Even Chris acknowledges that success often hinges on what he calls "information parity"—the point at which social chatter becomes mainstream news. Timing this perfectly, however, is far from easy.

Another limitation is that the trend you're betting on may represent only a small portion of a company’s overall revenue (as in the AB InBev example). In such cases, even a significant spike or drop in sales may not move the stock price by much.

P.S. Liking this issue? Forward to a friend 🧑🤝🧑

Headhunted 🦅

Recently funded private companies need talent! Scout jobs at recently funded European startups, ahead of your competition. 💪

Ameba 🇬🇧 - Retail supply chain startup closes $7.1m seed round. Hiring a founder associate and a software engineer (link)

Flinn 🇦🇹 - Medical device compliance startup secures a €6m seed round. Hiring a sales dev rep (link)

Pact 🇬🇧 - Biomaterials startup raises €10.7m seed round. Hiring a design project manager (link)

Marple 🇧🇪 - The data analysis platform for engineers recently closed a new funding round. Now hiring engineers & a customer success manager (link)

Newcleo 🇬🇧 - Nuclear unicorn closes a new €48m funding round. Ton of jobs available now (link)

Interestingness📔

From the Wall Street Bets subreddit

📚 New to investing? Grab a PDF copy of my ebook here.

As always, the financial disclaimer!

This is not investment advice. I am not a financial advisor. Make sure to conduct your thorough research before purchasing or selling financial products.